doordash business address for taxes

Ad Talk to a 1-800Accountant Small Business. Paper Copy through Mail.

How To Fill Out Schedule C For Doordash Independent Contractors

This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes.

. Take note of how many miles you drove for DoorDash and multiply it by the Standard Mileage deduction rate. Paper Copy through Mail. You will pay to the Federal IRS and to the State separate taxes.

It should be included in the 1099 info that Doordash sends you. A 1099-NEC form summarizes Dashers earnings as independent. Is a corporation in San Francisco California.

Please contact the moderators of this subreddit if you have any questions or concerns. The forms are filed with the US. DoorDash will send you tax form 1099.

BUSINESS ADDRESS EIN 462852392 An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. Your FICA taxes cover Social Security and Medicare taxes 62 for Social Security and 145 for Medicare. It doesnt apply only to.

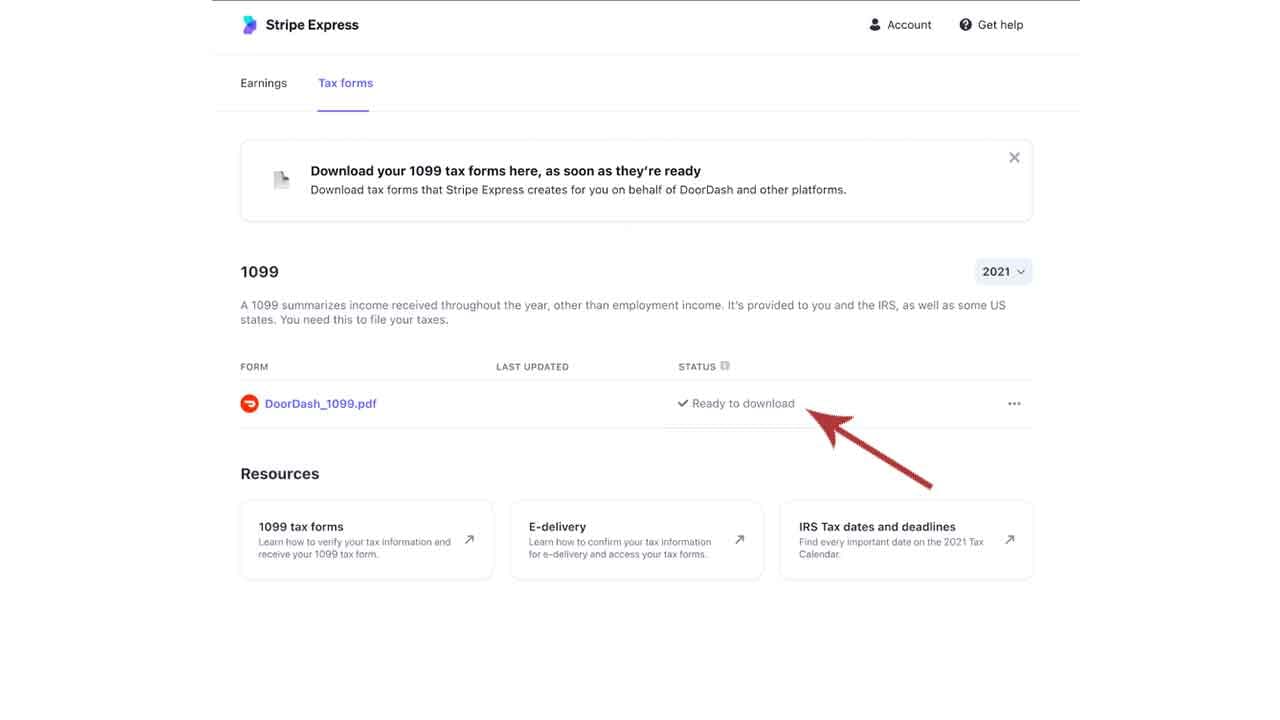

Your biggest benefit will be the. The self-employment tax is your Medicare and Social Security tax which totals 1530. Choose the expanded view of the tax year and scroll to find Download Print Form just above the Close button.

Yes - Just like everyone else youll need to pay taxes. Does DoorDash send you. Please allow up to 10 business days for mail delivery.

DoorDash dashers will need a few tax forms to complete their taxes. EIN for organizations is sometimes also referred to as. A 1099 form differs from a W-2 which is the standard form issued to.

The employer identification number EIN for Doordash Inc. You are considered as self-employed and in IRS parlance are operating a business. This means you will be responsible for paying your estimated taxes on your own quarterly.

- All tax documents are mailed on or before January 31 to the business address on file with DoorDash. It may take 2-3 weeks for your tax documents to arrive by mail. Dashers will not have their income withheld by the.

DoorDash will file your 1099 tax form with the IRS and relevant state tax authorities. 1 Best answer. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash.

If you dont consent to e-delivery by January 6. Internal Revenue Service IRS and if required state tax departments. Income from DoorDash is self-employed income.

Tap or click to download the 1099 form. How Do Taxes Work with DoorDash. DoorDash drivers are expected to file taxes each year like all independent contractors.

Tax Forms to Use When Filing DoorDash Taxes. All you need to do is track your mileage for taxes. March 18 2021 213 PM.

If you earned more than 600 while working for DoorDash you are required to pay taxes.

Doordash 1099 How To Get Your Tax Form And When It S Sent

Doordash Taxes Does Doordash Take Out Taxes How They Work

Charge Me For Tax When There Is None I Am From Montana Where There Is Currently No Sales Tax When I Place My Order However There Is Always A Tax On My

Doordash 1099 How To Get Your Tax Form And When It S Sent

How To Get Doordash Tax 1099 Forms Youtube

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How Do Food Delivery Couriers Pay Taxes Get It Back

How Can I View My Delivery History With Doordash

Doordash 1099 How To Get Your Tax Form And When It S Sent

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash Taxes Schedule C Faqs For Dashers Courier Hacker

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How To Do Taxes For Doordash Drivers 2020 Youtube

Guide To 1099 Tax Forms For Doordash Dashers And Merchants Stripe Help Support

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier

Form 1099 Nec For Nonemployee Compensation H R Block

Guide To 1099 Tax Forms For Doordash Dashers And Merchants Stripe Help Support